Tosin Faola, an Atradius Senior Underwriter, provided us with insights into the Machines Industry so far this year compared to previous years.

Machines Industry Over the Past Few Years

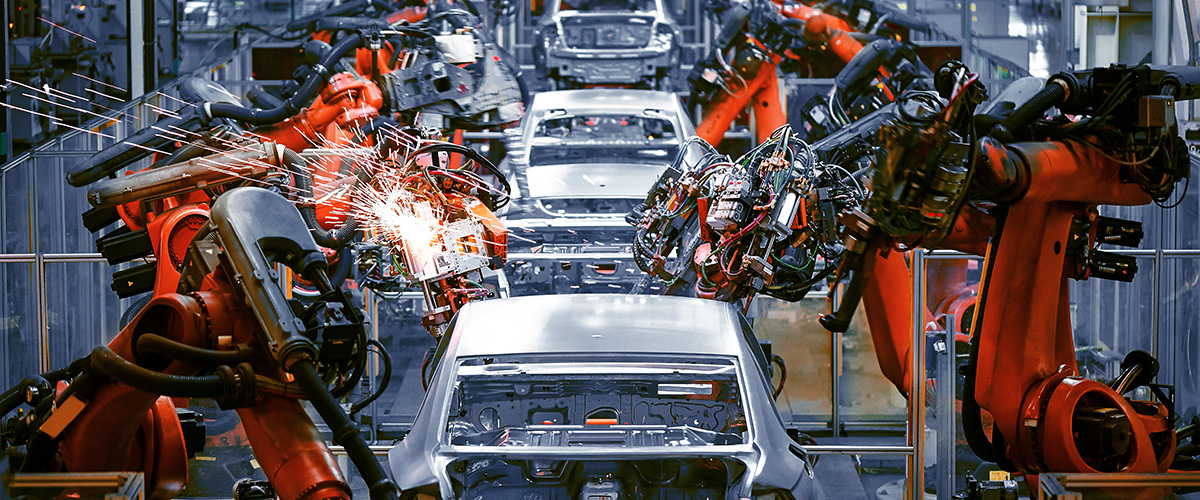

In recent years, geopolitical uncertainty, supply chain disruptions, changing consumer preferences, and increasing regulatory scrutiny have presented several challenges for the machines industry. While challenges have existed, we also see several positive factors. Global demand is rising, technological advancements are ongoing, and there is increasing investment in automation and digitalization. These factors continue to influence the market, and the overall outlook for manufacturing remains slightly positive.

Looking at the US

In the United States specifically, the manufacturing output market contracted 2.7% compared to 5.5% in 2022. This implied a weaker year than expected in 2023. This primarily stems from rigid lending conditions and low consumer spending on cars and homes, which impacts the automotive, agriculture, and construction sectors. These are key end-use sectors for machinery.

Moving Forward into 2024

The machines industry outlook remains the same in 2024 with a 0.5% contraction, coupled with anticipation for a stronger rebound of 3.1% in 2025 as macroeconomic factors become favorable. Strong demand from end-use markets, fiscal policy, and increased technology spending will be sources of growth over a medium-term period. Even though the outlook has improved, the laggard effect of monetary easing will delay recovery since it will take time to influence the economy. Additionally, while investment in machinery and equipment is forecast to grow this year by 1.1%, the impact on output shouldn’t materialize until after two to three quarters. Downstream demand from the automotive, transport, construction, and other equipment manufacturing sectors we expect to support demand given robust consumer spending. Support from the construction sector will grow by 4.4% in 2024. The construction sector accounts for 23% of sector output consumption.

Our most recent full industry report can be found here.