Indicating steady growth, artificial driven innovations, industrial automation, and digitalization. Semiconductor production, in particular, is expected to see robust expansion, supported by government initiatives like the CHIPS and Science Act. The industry is also prioritizing cloud computing, data processing, and cybersecurity solutions to meet evolving business needs. Overall, the US Electronics and ICT sector is poised for sustained development, maintaining its global leadership position.

How can you protect your business from factors such as tightened credit control and liquidity shortages impacting the electronics industry?

Get A Trade Credit Insurance Quote

Our international team of trade experts is here to help. Contact us to learn more about our coverage options for the ICT / Electronics Industry or request a free, no obligation quote that includes credit reports for your largest trade partners.

Electronics and ICT Industry

The Electronics and ICT industry in the US is a major driver of innovation and economic growth. It encompasses sectors like semiconductors, telecommunications, cloud computing, and cybersecurity. The industry is expected to grow steadily, fueled by advancements in AI, industrial automation, and digitalization.

The Electronics and ICT industry in the US is a major driver of innovation and economic growth. It encompasses sectors like semiconductors, telecommunications, cloud computing, and cybersecurity. The industry is expected to grow steadily, fueled by advancements in AI, industrial automation, and digitalization.

But is this picture as bright as some might suggest? Could geopolitical issues surrounding the production of semiconductors create issues downstream? Are parts of the ICT market nearing saturation and is there a risk of oversupply?

Curious About Pricing?

Atradius is here to help. Contact us to learn more about our coverage options or request a free, no obligation quote that includes credit reports for your largest trade partners.

ICT/electronics businesses anticipate that there will not be improvements to business and sales performance from exports in the coming months. To offset additional risk from a significant rise in DSO, businesses will have to request additional payment guarantees from their customers. If multiple countries invest in similar technologies to semiconductor production, this could lead to an inefficient use of resources and oversupply of similar products.

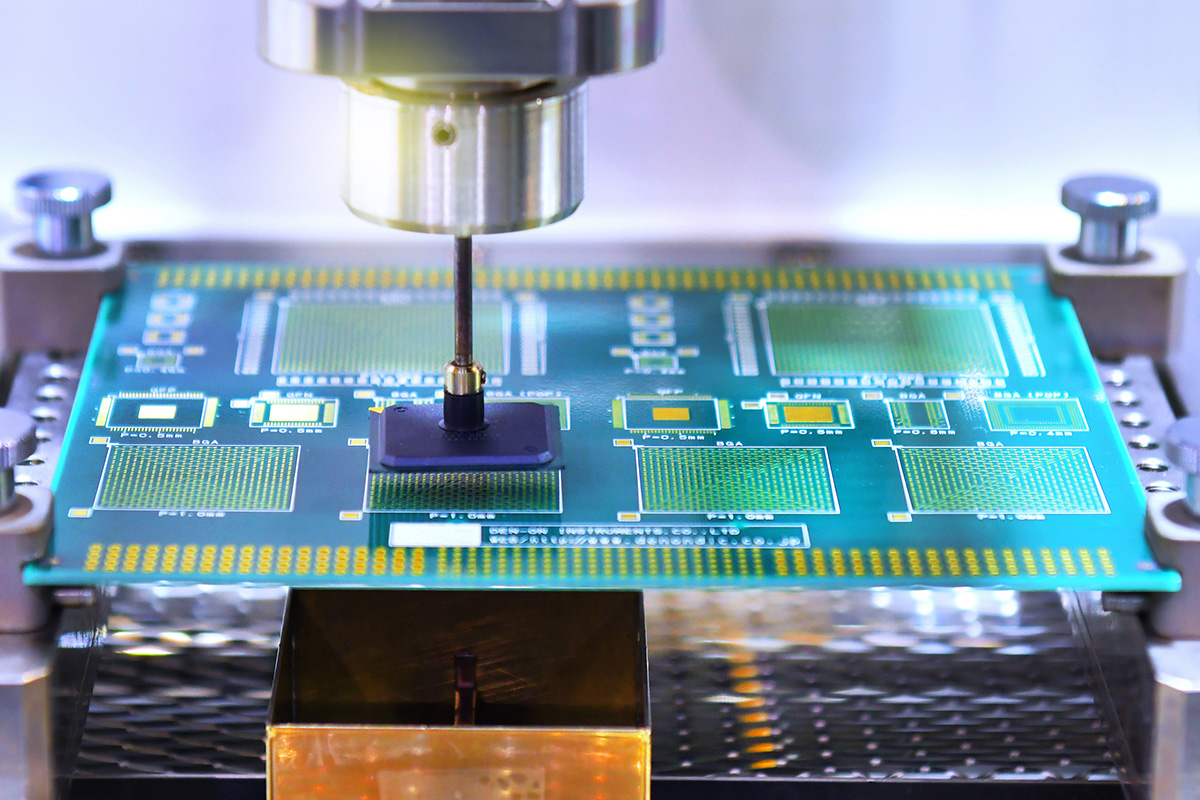

The chip shortage has created major obstacles for the Electronics and ICT industry, including disrupted global supply chains, increased production costs, and delayed product launches. This scarcity has strained innovation, slowed the development of cutting-edge technologies, and exposed the risks of heavy reliance on foreign suppliers. Geopolitical tensions and trade restrictions have further aggravated the issue. Efforts like increased domestic chip manufacturing aim to address these challenges, but recovery remains an ongoing process.

Deteriorating customer payment practices have caused 52% of U.S. ICT/electronics businesses to report overdue credit sales. Subsequently businesses that manage their credit risk internally have had to spend more wasted time and resources chasing unpaid invoices.

To ensure optimal liquidity, businesses have leaned on overdraft extensions, further delaying overdue payments to suppliers. Delays have also been fuelled by an increase in costs associated with acquiring assessments of credit quality and trade risk.

One potential consequence of US-China tensions is the possibility of growth in some of the emerging economies in Asia. The US restrictions will impact the production volume of products and industries that require high-end chips, from smartphones, and AI, to EV. With a lack of the necessary components on the market, production may be shifted to other countries, such as Vietnam and India, where production costs tend to be lower. Asia’s semiconductor producers are also vulnerable to further actions caused by US-China trade tensions. For example, in response to US sanctions, China imposed export controls on gallium and germanium, two critical materials in the chipmaking process. While the Asian producers can source the materials from other countries, it is costly in terms of time and money, as China is a main producer of the materials.

Semiconductor production is a strategic priority for Asia, Europe and the US, with legislation and subsidies used in several countries to support growth and reshoring. This unilateral approach to semiconductor development could lead to duplicated efforts. When chips of a new generation come to the market, the old one will become obsolete. If not managed carefully, there could be a potential oversupply of older generation chips. If advanced markets like the EU and the US expand their semiconductor production, it is likely that the higher labor costs and other overheads will result in higher prices for consumers. This could be called a devolution of the economies of scale.

There are those added value items, like customer service, which go far beyond just being able to place a claim. That’s where I think Atradius shines.

Benefits to Credit Insurance

Trade credit insurance is a risk management tool that can help protect your company’s commercial accounts receivable from the devastating effects of loss caused by a bankruptcy or protracted default of your buyers. No company wants to face the unknown. At Atradius, we give our clients peace of mind knowing that their policy protects them from a customer’s sudden inability to pay. Especially in an industry that must adhere to high-cost environmental regulations, trade credit insurance can help with cash flow and to ensure companies are financially stable.

Get Your Questions Answered or Request a Quote

Atradius is here to help. Contact us to learn more about our coverage options or request a free, no obligation quote that includes credit reports for your largest trade partners.