Rising Inflation Prompts Businesses to Strengthen Management of Customer Credit Risk, Atradius Survey Reveals

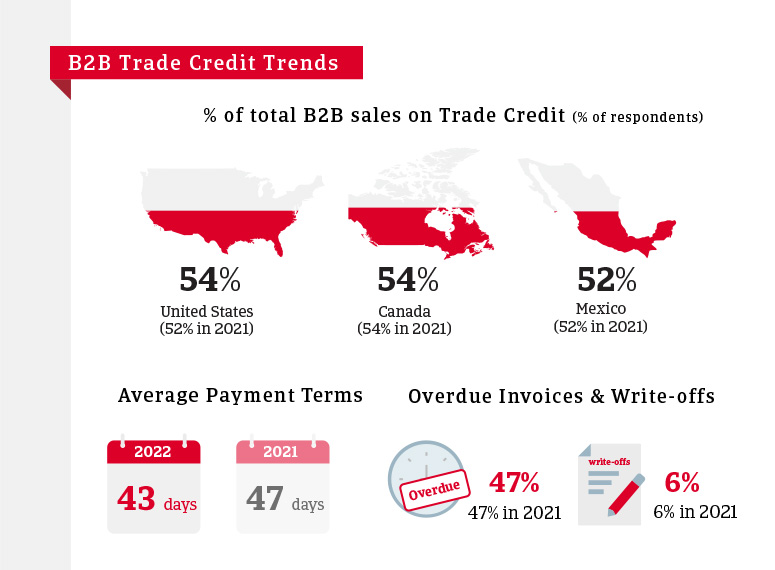

The results of our latest Payment Practices Barometer of surveyed businesses provides insights on the various methods for coping with the disruptive challenges impacting trade and economic conditions. Businesses in a variety of industries in the USMCA region (Canada, Mexico and the U.S.) completed the survey during the second quarter of 2022. The key results are clear and indicate rising inflation costs are weighing on businesses.

Here are some key results:

- United States

- 33% of businesses in the electronics/ICT industry reported using trade credit policies to grow B2B sales by attracting new customers.

- The number of U.S. companies chasing external finance to ease liquidity troubles drastically increased this year.

- Canada

- 63% of businesses reported unchanged DSO compared to 2021.

- 61% of Canadian businesses outsourced trade finance management solutions.

- Mexico

- Survey results report that Mexican businesses experienced a 10% increase in levels of both B2B payment defaults and debts written off as uncollectable.

- Protection against unexpected losses has become a primary challenge for Mexican businesses.

- 59% of businesses offered longer terms to encourage more wins with new businesses.

Businesses from these regions report that pressures from inflation are a concern. Many of those surveyed addressed these challenges by adjusting their credit risk management plans. Atradius Regional Director of North America, Gordon Cessford notes that due to rising inflation costs, businesses should remain vigilant of their existing credit management strategies.

“While inflationary pressures are broad-based worldwide, a strong upward push to the figure in the USMCA region is a result of the spill-over effects of soaring energy and commodity prices at global level. We see that USMCA companies struggle to alleviate such pressure, thus increasing their liquidity needs to run their business operations and up costs.”

Get in Touch

Looking For a FREE Quote?

Obtaining a free Trade Credit Insurance quote or just some more information is fast and easy! Get in touch with us today.

Get Started Call 800-822-3223“For many companies, strategic credit management has represented the most logical step to protect profits and cash flow, while at the same time mitigating customer credit risk during this period of dramatic surge in inflation and unsettled economic times.”

To see our full report on the USMCA region, click here.